Music & Copyright’s annual survey of the recorded-music and music publishing sectors has revealed the changes in global market share for the three major music groups and the independent sector. UMG remained the overall global music group leader last year, but for the third year in a row, second-placed SMG reduced the gap. UMG’s recorded-music share was down slightly for the third consecutive year, while SME has registered share growth for four straight years. WMG’s share fell back for a second year, and the independent sector’s share edged down after a modest rise in 2022. For publishing, SMP extended its lead over second-placed UMPG, while WCM’s share was up for the third straight year. The collective share for the independent sector fell below 40% for the first time since 2014.

Modest changes in recorded-music market shares

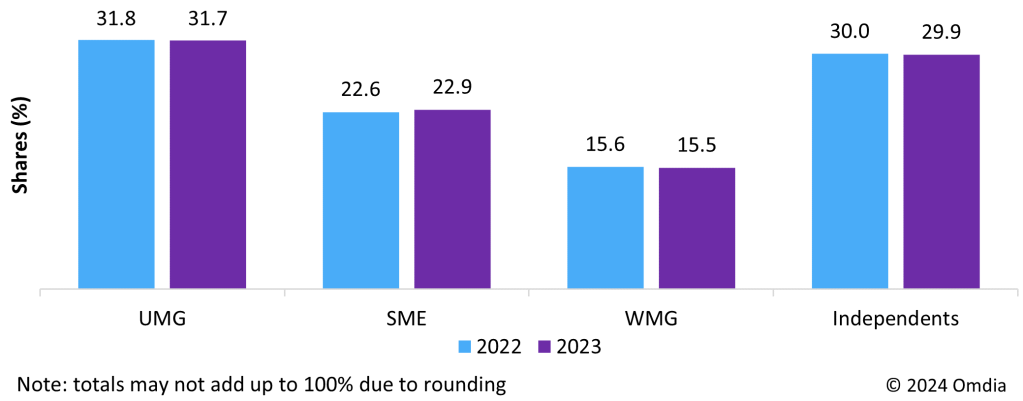

According to Music & Copyright, UMG remained the top company for combined physical and digital recorded-music trade revenue in 2023. The leading major accounted for 31.8% of the total compared with 31.9% in 2022. For digital revenue only, UMG’s share was down, to 32.4% from 33%, while the company’s physical share increased, to 29.3% from 27.6%.

Record companies, digital- and physical-revenue market shares, 2022 and 2023

Source: Music & Copyright

Source: Music & Copyright

SME’s position as the second-largest record company was maintained. Moreover, the company was the only one of the three majors not to lose combined digital/physical share. Last year, SME accounted for an unchanged 22.1% of the total. The company’s digital share grew to 23.5% from 23.2%, while its physical share was down to 16.6% from 17.7%. SME’s share of all recorded-music trade revenue, which includes licensing and other revenue as well as income from physical and digital music sales, increased to 22.9% from 22.6%.

Record companies, total recorded-music-revenue market shares, 2022 and 2023

Source: Music & Copyright

Source: Music & Copyright

The smaller of the three majors, WMG, suffered a dip in share for both digital and physical sales for the second year in a row. According to Music & Copyright, WMG’s digital share was down last year, to 16.8% from 17.2% in 2022. The company’s share of physical sales fell to 10.4% from 10.9%. The results meant WMG’s combined digital/physical share slipped to 15.5% from 16%. Collectively, the independents saw a rise in digital share for the second consecutive year. The share last year was up to 27.3% from 26.6%. For physical formats, the independents’ share edged down to 43.7% from 43.8%. The results meant independent companies’ combined digital/physical revenue share grew to 30.6% from 30%.

Rise in publishing shares for SMP and WCM

Music & Copyright has calculated that global music publishing revenue topped the $9bn milestone for the first time last year. Total income increased 10.9%, to a record high of $9.03bn from $8.14bn in 2022. Last year’s growth rate was down on the 17.7% rise in 2022 and 17.6% improvement in 2021.

Not only did SMP maintain its leading position ahead of UMPG last year, but the gap between the two widened slightly to 1.5 percentage points from 1.3 points in 2022. SMP’s share edged up to 24.9% from 24.7%. UMPG’s publishing share edged down to 23.3% from 23.4%.

Music-publishing companies’ revenue market shares, 2022 and 2023

Source: Music & Copyright

Source: Music & Copyright

Third-placed WCM registered the third consecutive annual rise in share. Moreover, WCM’s share was the highest for more than 10 years. Music & Copyright estimates the company accounted for 12.4% of global publishing revenue in 2023 compared with 12% in 2022. Although the collective share of independent music publishers maintained a healthy lead, the share slipped last year to 39.4% from 40%. For more market share details and further analysis just follow this link.

If you would like more information about the newsletter or to set up a subscription, then send us an email Alternatively, if you would like to download a sample copy, just go here.

You must be logged in to post a comment.