Looking into the potential of Africa as a possible source of recorded-music sales always seems to end with depressing results. South Africa is the only market with reliable figures as the rest of the region is dominated by piracy. But, the rise in the level of active mobile subscriptions just may provide some hope for the music industry. According to Informa Telecoms & Media, the publisher of Music & Copyright, Africa crossed the half-a-billion mark for mobile subscriptions in 3Q10, reaching 506 million at end-September. Africa accounts for 10% of the world’s mobile subscriptions and is one of the world’s fastest-growing regions – with the subscription numbers increasing 18% over the year to end-September – as a result of the still low mobile penetration rate on the continent as well as demand for new services.

The rate of growth in mobile subscriptions in Africa will slow as markets mature, but the continent continues to offer great opportunities for investors in the music industry, particularly as mobile broadband and mobile-money services are starting to take off. By 2015 Informa says there will be 265 million mobile broadband subscriptions in Africa, a huge increase from the current figure of about 12 million. Mobile broadband subscriptions will account for 31.5% of the total of 842 million mobile subscriptions that the continent will have in five years’ time.

One of the key drivers for the growth is the increasing availability of low-cost feature-rich mobile phones; mobile Internet and multimedia-capable handsets are now available for under US$50. Fixed-Internet penetration is low in most African countries with the rate of household broadband penetration currently at around 3%, so African broadband has a long way to go if it is to emulate the mobile revolution that has already swept through much of the continent.

So what does this mean for the music industry?

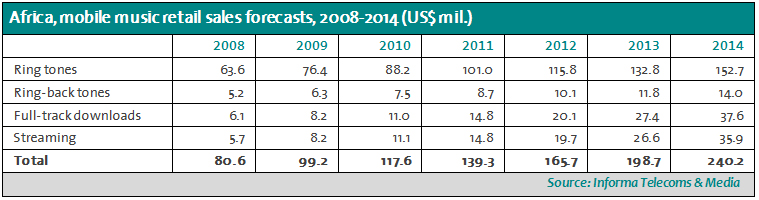

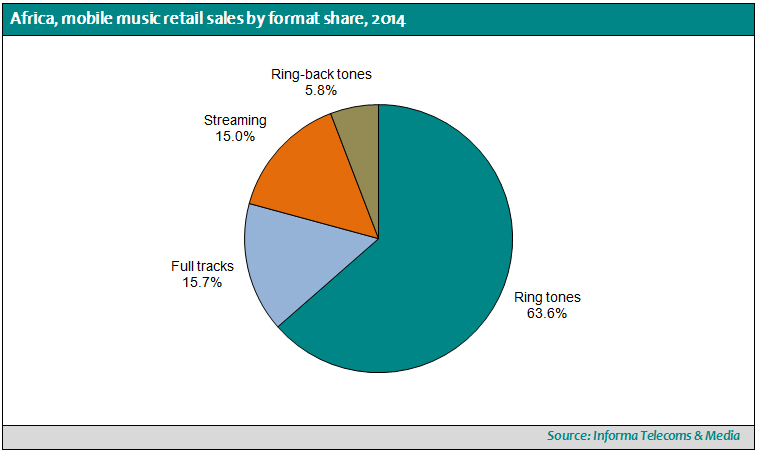

Well, earlier this year Informa forecast that retail revenues from mobile music services in Africa would increase 142% between end-2009 and end-2014, from US$99.2 million to US$242.2 million in 2014. At a time when recorded-music sales are falling in much of the rest of the world and Africa is struggling to combat piracy, this is a little bit of good news. Although full-track downloads and music streaming are set to experience the sharpest growth in the period, ring tones are expected to remain the largest revenue generator, accounting for 63.6% of total sales in 2014.

Music & Copyright is a fortnightly research service published by Informa Telecoms & Media.

One thought on “Africa looking more like a mobile music market ready for the taking”

Comments are closed.