Music & Copyright’s annual survey of the recorded-music and music-publishing sectors has revealed which companies have benefited most from the breakup of EMI. UMG increased its dominance of the recorded-music sector in 2013, while WMG closed the gap on the second-largest company, SME. Sony/ATV is the clear leader in terms of corporate publishing control.

Music & Copyright’s annual survey of the recorded-music and music-publishing sectors has revealed which companies have benefited most from the breakup of EMI. UMG increased its dominance of the recorded-music sector in 2013, while WMG closed the gap on the second-largest company, SME. Sony/ATV is the clear leader in terms of corporate publishing control.

The last two years have seen significant consolidation in the recorded-music and music-publishing sectors, after the breakup of EMI Music Group and the subsequent sales of EMI’s record and publishing divisions. Although UMG’s acquisition of EMI Recorded Music and the purchase of EMI Music Publishing by a Sony-led consortium received the various national and regional regulatory seals of approval in 2012, enforced divestments meant that the consolidation process was completed only last year. The result is a music industry dominated by three corporate groups: UMG has extended its market-share lead in terms of revenues from recorded-music sales, and Sony/ATV is the clear music-publishing leader.

Prior to the latest round of consolidation, UMG was the biggest recorded-music company in the world. The addition of the EMI assets in October 2012 boosted the company’s market share that year, but 2013 was the first full year the acquired EMI companies were included in UMG’s results. However, given that divestments were completed only in 2013, market-share figures for 2014 will be the first to truly reflect the new recorded-music landscape.

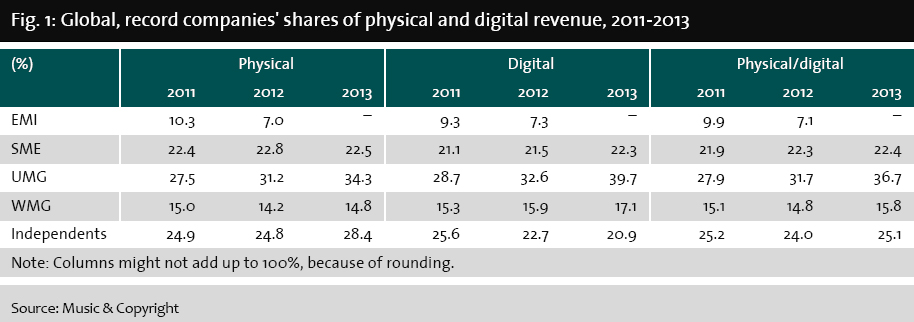

According to Music & Copyright’s annual survey of the music industry, UMG had a 36.7% share of combined physical and digital recorded-music trade revenues last year, up from 31.7% in 2012 (see fig. 1). For physical revenues only, UMG’s share stood at 34.3% last year, while its digital share was 39.7%.

SME was the second-largest music company, with a combined physical/digital market share of 22.4%, marginally up from the 2012 share of 22.3%. The company increased its digital-market share but lost share in terms of physical sales.

Now the smallest of the three majors, WMG experienced an increase in both physical and digital shares. The company’s share of revenues from physical recorded-music sales increased, to 14.8% last year, from 14.2% in 2013. For digital, the share gain was higher, rising from 15.9% to 17.1%. WMG’s combined physical/digital share rose, from 14.8% to 15.8%.

In addition to market-share gains by the three remaining majors, independent record companies’ share of combined physical/digital revenues also rose last year, to 25.1%, from 24% in 2012. However, the gain for the independent sector came from a rise in the share of physical-format revenues rather than digital. Independent companies’ share of physical revenues rose to 28.4%, from 24.8%, while its share of digital revenues slipped, from 22.7% to 20.9%.

Publishing gains for the independent sector

Similar to the way in which Music & Copyright determines global recorded-music market shares, music-publishing market shares are based on revenues received by each company. Music & Copyright has calculated that global music-publishing revenues were up 2.4% in 2013, at US$3.95 billion, from US$3.86 billion in 2012.

Sony/ATV increased its publishing share last year, to 29.4%, from 21.7% in 2012 (see fig. 2). Although Sony/ATV and EMI MP are still separate companies, with EMI MP repertoire administered by Sony/ATV, Music & Copyright has combined the companies’ shares. EMI MP is the larger of the two companies in terms of tracks owned and administered, with a publishing catalog of around 2 million tracks, compared with 1.5 million for Sony/ATV.

UMPG is the second-largest music publisher. The company’s market share was up slightly last year, to 22.6%, from 22.5% in 2012. Warner Chappell was the only major music publisher to suffer a fall in share in 2013.

Independent music publishers have long dominated music publishing and compete well with the majors for major artists’ attention. Last year, the independent music-publishing sector experienced a rise in share. Music & Copyright estimates that independent companies accounted for 34.8% of publishing revenues, compared with 32.7% in 2012.

If you want to know more about Music & Copyright then follow the below links.

Music & Copyright is published by Informa Telecoms & Media.

You must be logged in to post a comment.