Music & Copyright’s annual survey of the recorded-music and music publishing sectors has revealed the changes in global market share for the three major music groups and the independent sector. In a repeat of the last review, UMG enhanced its position as the global leader. The company registered gains in both digital and physical market shares, while the publishing unit UMPG saw its share rise. Second-placed SME had a flat year for digital but lost share overall because of a dip in the company’s physical format share. For publishing, Sony’s share was down for the second consecutive year. Smaller major WMG saw its digital share rise but the overall recorded-music performance was unchanged year-on-year because of a dip in the company’s physical share. The independent sector had a mixed year with a fall in its digital recorded share more than offsetting a slight rise in the physical share. The sector enhanced its publishing dominance with a second straight year of share growth.

UMG makes share gains at the indies expense

According to Music & Copyright, UMG increased its share of combined physical and digital recorded-music trade revenue last year, to 31.8% from 29.8% in 2018 (see Figure 1). For digital revenue only, UMG’s share was up to 33.8% from 32.4%, while its physical share grew to 25.8% from 23.4%.

Figure 1: Record companies, physical- and digital-revenue market shares, 2018 and 2019

Source: Music & Copyright

Source: Music & Copyright

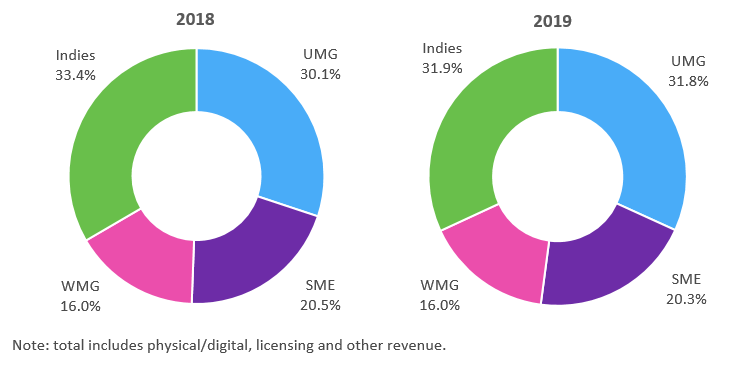

SME was the second-largest record company, although its combined physical/digital market share slipped slightly last year to 19.8% from 19.9% in 2018. For the third consecutive year, SME registered a year-on-year fall in its physical format performance with a dip in share to 18.3% from 19.2%. However, following two years of decline, SME’s digital market share was unchanged last year, at 20.2%. The company’s share of all recorded-music trade revenue, which includes licensing and other revenue as well as income from physical and digital music sales, edged down, to 20.3% from 20.5% (see Figure 2).

Figure 2: Record companies, total recorded-music-revenue market shares, 2018 and 2019

Source: Music & Copyright

Source: Music & Copyright

The smaller of the three majors, WMG, experienced a reversal of its 2018 results, when the company’s digital share was down and its physical share up. Last year. WMG’s digital share increased slightly to 17.9% from 17.7%, while its physical share slipped to 11.7% from 13.4%. Overall, WMG’s combined physical/digital share edged down to 16.4% from 16.5%, while its total revenue share was unchanged at 16%.

Despite the changes in the majors’ shares, independent record companies’ combined physical/digital revenue share remained ahead of UMG’s, but only just. The independent company sector’s physical share stayed high at 44.2%, but a fall in the sector’s digital share resulted in the physical/digital share decreasing to 32% from 33.8%.

Slowdown in music publishing

In line the way in which Music & Copyright determines global recorded-music market shares, music publishing market shares are also based on revenue received by each company. Music & Copyright has calculated that global music publishing revenue grew 2.2% last year to $5.59bn from $5.47bn in 2018. The growth rate was notably lower than the 11.4% rise in 2018 and 11.2% increase in 2017. Sony maintained its leading position ahead of UMPG but suffered a fall in share for the second consecutive year. Sony’s share, which is made up of revenue from Sony/ATV, EMI Music Publishing (EMI MP), and Sony Music Publishing Japan, was down a single percentage point, to 26% from 27% (see Figure 3). Sony took the top spot in 2013 following the purchase of EMI MP by a Sony-led consortium in 2012. Sony then acquired the approximate 60% of the interest in EMI MP held by the consortium in November 2018, resulting in EMI MP becoming a wholly owned subsidiary of Sony.

Figure 3: Music-publishing companies, revenue market shares, 2018 and 2019

Source: Music & Copyright

Source: Music & Copyright

UMPG was the second-largest music publisher last year. Music & Copyright estimates the company’s share grew for the second year in a row, to 21% from 20.2% in 2018. Furthermore, UMPG was the only major publisher to increase its share. Third placed Warner Chappell Music’s share was down last year, to 11.6% from 12.3%. The collective share of independent music publishers was up, to 42.3% from 41.4%.

If you would like more information about the newsletter or set up a subscription, then send us an email

You must be logged in to post a comment.