The latest issue of Music & Copyright is now available for subscribers to download. Here are some of the highlights.

SPECIAL FOCUS: Deal dollars keep on flowing despite troubles at Hipgnosis

There are fears that the hectic buying and selling of music catalogs for hundreds of millions of dollars over the past few years represents a financial bubble. The ongoing difficulties of rights fund Hipgnosis have only enhanced those suspicions, while rising interest rates have also increased anxieties. But, while there have been instances of profit-taking, the funding for catalog deals remains healthy, with several investors happy to take a longer-term view. Moreover, with central banks set to ease their tight monetary policies and reduce rates, leading investment funds are continuing to find the cash to finance further acquisitions.

NEWS FEATURE: Seven straight years of collection growth for Bulgaria’s Musicautor

Bulgarian authors’ society Musicautor has reported a seventh consecutive year of rising collections. Although last year’s growth rate was down on the size of the rise in 2022, the rate of improvement in receipts was the second highest in eight years. TV maintained its position as the biggest income source for Bulgarian authors and publishers despite persistent low rates paid by the country’s broadcasters. Concert collections more than doubled, with the number of licensed events increasing to record levels. Digital collections were down year-on-year, but the prior year’s total was inflated by backdated receipts. A return to normality after the COVID-19 pandemic continued to boost general licensing income. Moreover, collections for cinema and theater, two sectors badly affected by the pandemic, also registered sharp growth. Mechanicals benefited from higher sales of CDs and vinyl.

SECTOR ANALYSIS: Afrobeats and amapiano lead Africa’s international music charge

African music is finding real favor outside its home continent. The region’s musicians are now regularly performing in front of large, non-domestic audiences, charting strongly in the US, and picking up prestigious honors. Moreover, South African–born amapiano music has joined afrobeats as one of the leading African genres internationally, with further hybrids set to cut through. Leading music industry players are already making their moves on the continent, but they need to put resources into supporting emerging artists and sector professionals to ensure the development of a resilient African music business.

If you would like more information about the newsletter or to set up a subscription, then send us an email Alternatively, if you would like to download a sample copy, just go here.

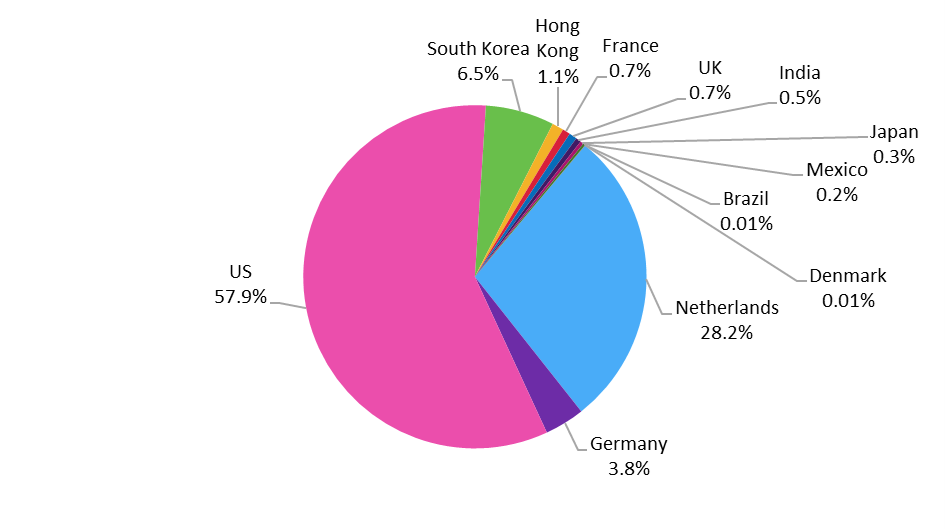

Source: Companies and stock exchanges

Source: Companies and stock exchanges Source: Omdia

Source: Omdia

You must be logged in to post a comment.