The annual survey by Ovum publication Music & Copyright of the recorded music and music publishing sectors has revealed that recorded-music leader UMG lost market share in 2014, mainly as a result of the sale of the Parlophone Label Group (PLG) to WMG in 2013, which formed part of EMI Recorded Music acquisition requirements. UMG’s loss was WMG’s gain and the smallest of the three majors narrowed the gap on second-placed SME. Sony/ATV held its lead in music publishing, but the collective share of the independent publishing sector was the highest overall.

Majors cede a little recorded-music market share to the independents

Following two years of consolidation in the recorded-music and music-publishing sectors after the breakup of EMI Music Group and the subsequent sales of EMI’s record and publishing divisions, restructuring and company selloffs have had an impact on the market share figures for the major music groups in 2014.

UMG acquired EMI Recorded Music and a Sony-led consortium of companies bought EMI Music Publishing in 2012. National and regulatory approval required a number of company sales, which were completed with the sale of the PLG in July 2013. The timing of the sale meant year-on-year market-share comparisons for UMG and WMG this year and in 2013 were affected. Moreover, at the time of the PLG acquisition by WMG, the major said it would sell some of the PLG assets, or their equivalent value of owned assets, to independent companies. Strong interest by the independent sector has delayed the asset sales with more than 140 companies reported to have bid for around 11,000 artist catalogs. Should the selloffs be completed this year, WMG’s 2015 market share may well be negatively affected.

UMG is the recorded-music leader despite a market share dip

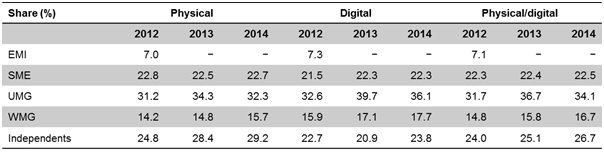

According to Music & Copyright’s annual survey of the music industry, UMG had a 34.1% share of the combined physical and digital recorded music trade revenue last year, down from 36.7% in 2013. For physical revenue only, UMG’s share stood at 32.3%, while its digital share was 36.1%. SME was the second-largest music company, with a virtually unchanged combined physical/digital market share of 22.5%.

Record companies, physical and digital revenue market shares, 2012–14

Source: Music & Copyright

The smallest of the three majors, WMG, was the only company to experience an increase in both physical and digital shares: Its share of revenue from physical recorded music sales was 15.7% in 2014, up from 14.8% in 2013, while the share gain was slightly lower for digital, rising to 17.7%, from 17.1%. WMG’s combined physical/digital share grew, to 16.7%, from 15.8%.

The independent record companies’ share of combined physical/digital revenue also rose last year, to 26.7%, from 25.1% in 2013. The sector increased its share of both physical and digital revenue. However, the independents’ share of physical formats is still higher than its digital share.

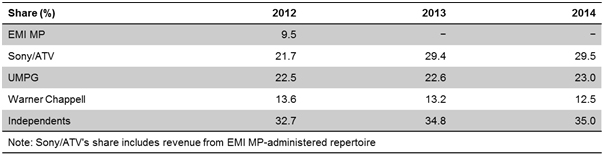

A healthy year for music publishing

Music & Copyright has calculated that global music publishing revenue grew 2.5% in 2014, to $4.05bn, from $3.95bn in 2013. Despite a virtually unchanged market share in 2014 of 29.5%, Sony/ATV, the joint venture between Sony and the Michael Jackson Estate, remained the global publishing leader. Although Sony/ATV and EMI MP are still separate companies, with EMI MP repertoire administered by Sony/ATV, Music & Copyright has combined the companies’ shares. EMI MP is the larger of the two companies in terms of tracks owned and administered, with a publishing catalog of around 2 million tracks, compared with 1.6 million for Sony/ATV.

Music publishing companies, revenue market shares, 2012–14

Source: Music & Copyright

UMPG is the second-largest music publisher. The company’s market share edged up slightly last year, to 23.0%, from 22.6% in 2013. Warner Chappell was the only major music publisher to suffer a fall in share in 2014.

Independent companies hold the lead

Independent music publishers have long dominated music publishing and compete well with the majors for major artists’ attention. Last year, the independent music publishing sector experienced a small increase in share: Music & Copyright estimates that independent companies accounted for 35.0% of global publishing revenue, compared with 34.8% in 2013.

BMG Rights Management is the biggest of the independent music publishers and has gained share consistently through a mixture of company acquisitions and administration deals. Music & Copyright estimates that BMG’s share of global music publishing revenue was 5.4% in 2014, up from 5.1% in 2013.

Kobalt has also made gains in the last few years, although increased revenue for the company has come from organic growth rather than through company acquisition. Music & Copyright estimates that Kobalt’s share of global publishing revenue increased to 3.9% last year, from 3.5% in 2013.

If you want to know more about Music & Copyright then follow the below links.

Music & Copyright is published by Ovum.

You must be logged in to post a comment.